The $600 Tax Rule: What Small Businesses Need to Know for 2024 (and Beyond)

Remember that $600 tax rule that made a splash a few years ago? You couldn’t open social media or news apps without seeing headlines about the new “Venmo tax” on your feeds.

Set to affect millions of small business owners and freelancers, the new lower reporting threshold for 1099-K forms was introduced in the American Rescue Plan Act of 2021. Since then, it’s been keeping small business owners and freelancers who use third-party settlement organizations (TPSOs) up at night.

Originally slated to go into effect in 2022, there have been multiple delays. The upside of the IRS punting is that there’s now more time to prepare for the changes, but the downside is that small business owners are even more confused about what’s next. Here’s the latest on when the $600 tax rule will go into effect, and more importantly, how you can start preparing now.

What is the $600 Tax Rule?

Let’s back up. You might be wondering what a 1099-K Form and the $600 rule is.

If you earn income through payment apps or online marketplaces (think apps like Venmo and PayPal, plus platforms like Etsy and eBay), those companies are required to report your earnings to the IRS on Form 1099-K. You will also receive a copy and should report the amount in Box 1a on your tax return.

What keeps changing, however, is the exact threshold for how much you earn before the IRS gets notified. Currently, the threshold is $20,000 and 200 transactions, but this latest update lowers the threshold to just $600 with no transaction minimum.

If this seems like a big difference, it’s because it is. When the threshold changes, the IRS expects to receive about 44 million 1099-K Forms—an increase of about 30 million. That’s a lot of new forms and paperwork for taxpayers and the agency to deal with.

So, why would the IRS propose a lower reporting threshold? Good question. With the new lower threshold, the IRS’s goal is to improve tax compliance by capturing income that previously went unreported, particularly from small business owners or freelancers who use their personal accounts to collect business income, potentially evading taxes.

When is the $600 rule going into effect?

The new qualification thresholds have raised a lot of concerns from payment processors, tax professionals, and taxpayers over the logistics of the transition. Half of self-employed people use peer-to-peer payment apps like Venmo or Cash App to run their businesses, but less than 23% of self-employed people understand the changes around the new 1099-K reporting threshold.

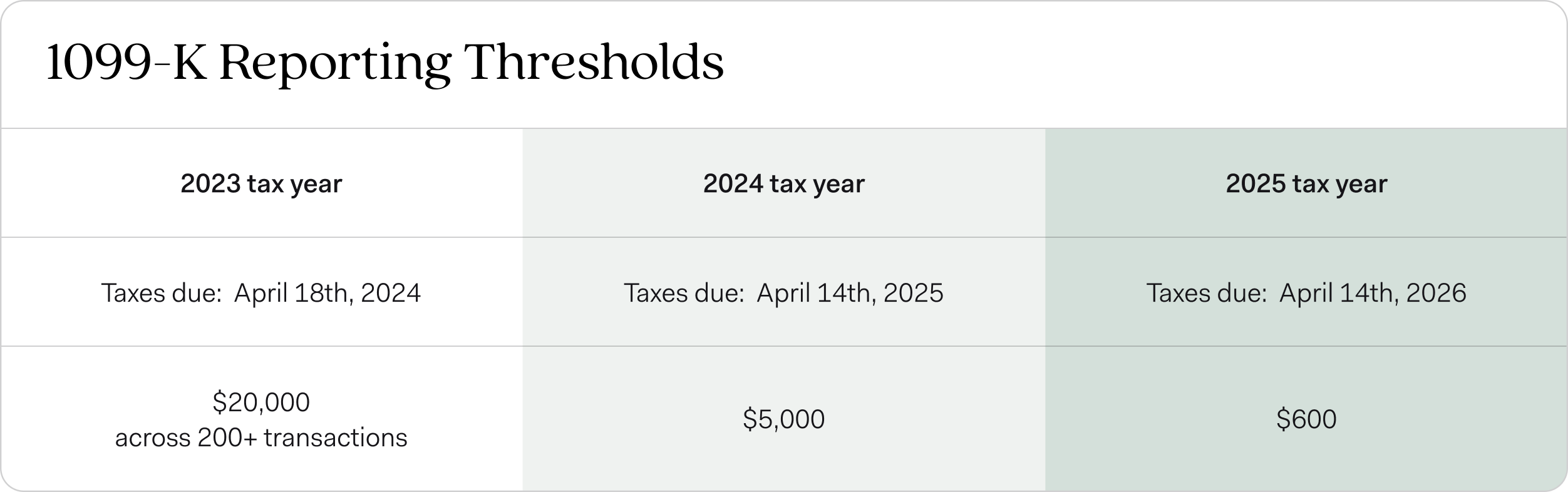

Although the changes to 1009-K reporting were supposed to take effect in 2022, the IRS delayed the implementation of the reduced threshold until 2023 due to widespread concern. Then, in November 2023, the IRS announced another delay and chose to phase the rollout over the next few years:

The 2023 tax year (taxes filed by April 2024) will be another transition year, with the old threshold of 200 payments or $20,000 threshold remaining in effect. It’s worth noting that filing requirements for some states might differ from federal requirements.

The 2024 tax year (taxes filed by April 2025) will have a $5,000 1099-K reporting threshold, instead of a $600 threshold.

Full implementation of the new law will roll out in the 2025 tax year (taxes filed in 2026).

The goal of the phased rollout is to give small business owners a chance to get their finances in order and prepare for the change in a gradual way.

What Does This Mean for Your Business in 2024?

While the threshold change offers some relief, it's still crucial to understand the implications for your business in 2024:

Income Reporting: Any business-related transactions exceeding $5,000 in 2024 will be reported to the IRS by TPSOs like Venmo or Cash App. Remember, this applies to all income, not just those transactions.

Self-Employment Tax: As a self-employed individual, you might be subject to self-employment tax (SE tax) on these earnings. This covers Social Security and Medicare contributions.

Accurate Record-Keeping is Key: Regardless of the amount, meticulously track all your business income, including transactions on these apps, to help ensure accurate tax reporting. This will ease your filing process and minimize potential penalties.

This new rule only applies to business-related transactions. Those Venmo transactions for splitting the pizza bill or sending your sister money for mom’s birthday gift are exempt.

5 Ways Small Business Owners Can Prepare for the $600 Tax Rule

Now that you understand the basics, here are some actionable steps to be tax-ready. Remember: The phased roll-out isn’t eliminating the rule; it’s simply delaying its inevitable rollout.

1. Understand the rule

First things first: You need to familiarize yourself with the details of the $600 tax rule, the timing of the phased rollout, and its implications for your business. The rollout has been plagued with delays, but the most recent implementation is a phased approach. Take a look at your income from last year and see if you would have been impacted.

2. Track your income accurately

Instead of just jotting down occasional business earnings, now’s the time to set up a system for recordkeeping. Separate every business transaction from your personal ones on Venmo and any other platforms you use.

This is why having a separate business bank account is crucial. When your business and personal expenses come out of the same account, it can be difficult to keep track of which is which—and that makes accurate reporting tough. Consider switching to an online bank account like Found which includes robust bookkeeping and tax tools. Remember, even small transactions add up, so capture everything for comprehensive reporting come tax season.

3. Make a plan for saving for estimated taxes

The new reporting threshold doesn’t change the fact that all income, regardless of the amount, is taxable. If you’ve been reporting your income made on these TPSOs, then this will simply be another form you receive.

However, if you’re been collecting payments via Venmo to skirt paying taxes, the new threshold could come back to bite you. Now that the platforms will be reporting these to the IRS, your taxable income will be higher, and you could likely face larger tax bills and higher estimated taxes. Make a plan to start saving for—and actually paying—those quarterly estimated tax payments now.

4. Consider changing payment processes

If a large chunk of your income flows through third-party platforms like PayPal or CashApp, the $600 tax rule could mean more paperwork and potential surprises down the line for your business. Now’s a good time to consider diversifying your payment methods to stay ahead of the curve.

Explore options with higher reporting thresholds, like business-specific accounts offered by some banks. Or find a platform like Found with built-in tax reporting features, simplifying your end-of-year tasks and ensuring seamless compliance. It might feel like a lot of work on the front end, but it could eliminate a lot of headaches (and paperwork) when the full implementation takes effect in 2025.

5. Stay informed

The IRS has delayed the rollout of the $600 tax rule a few times, so there’s a chance it could happen again. While small business owners shouldn’t count on that, it’s important to stay in the know in case it happens. The IRS regularly updates its website with critical changes that may affect your tax filing. Consider signing up for e-news subscriptions based on your interest and business type. You can also find other tax professionals who use their social media platforms to educate their audience about tax changes.

You should also consider hiring a CPA or tax professional if you have specific questions or concerns. They’ll be able to help you interpret how the rule applies to your business and ensure you’re complying with your tax obligations so you aren’t surprised by any unwanted penalties.

Get so much more for free

Found is the ultimate business bank account, with built-in bookkeeping and tax tools.

Get started

Navigating the $600 Tax Rule with Confidence

While the $600 tax rule might have initially caused a stir, the phased rollout and revised thresholds offer welcome breathing room for businesses who use these platforms for collecting income. The new threshold of $5,000 for 2024 gives you valuable time to prepare and understand your individual tax obligations.

Take this opportunity to build a stronger bookkeeping system, make a plan for estimated tax payments, and consult a tax professional if needed. These proactive steps will ensure you navigate the changes smoothly and stay compliant when the full implementation takes effect in 2026.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Related Guides

8 Changes Self-Employed People Need to Know When Filing 2023 Taxes

Accounting and Taxes

Your Venmo Tax Questions Answered: What To Know About The New 1099-K Form

Accounting and TaxesA Step-by-Step Guide to Filling Out the Schedule SE Tax Form

Accounting and Taxesfor the self-employed

*Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category.

The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc.

The information on this website is not intended to provide, and should not be relied on, for tax advice.

Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.